On December 1, 2020, the Centers for Medicare & Medicaid Services (CMS) finally issued the final rule for the 2021 Medicare Physician Fee Schedule (PFS). This was later than usual due to the public health emergency (PHE) and gives practices little time to prepare.

However, we found that the changes from the proposed rule were not too significant, so those who had prepared for the upcoming year based on the proposed rule should not have to make many changes. This article provides a summary of a few relevant topics for urology.

Calendar year 2021 conversion factor

On December 1, 2020, the Centers for Medicare & Medicaid Services (CMS) finally issued the final rule for the 2021 Medicare Physician Fee Schedule (PFS). This was later than usual due to the public health emergency (PHE) and gives practices little time to prepare.

However, we found that the changes from the proposed rule were not too significant, so those who had prepared for the upcoming year based on the proposed rule should not have to make many changes. This article provides a summary of a few relevant topics for urology.

The final calendar year (CY) 2021 PFS conversion factor (CF) was finalized at $32.41, which is a decrease of 10.2% from the CY 2020 CF of $36.09. In the proposed rule, the CF was to decrease by 10.6%.

The decrease is based on budget neutrality adjustments projected to impact the fee schedule, primarily reflecting the increase in relative value units (RVUs) assigned to evaluation and management (E/M) and related codes, which account for approximately 40% of all charges allowed under the Medicare fee schedule. Other factors projected to impact the final Medicare budget include changes to practice expense values based on market factor changes, malpractice updates, and changes to the geographic cost of practice indices started 2 years ago.

The impact to urology overall remains a projected 8% increase; the projections are based on payments to all urologists billing Medicare. Because of the decrease in the CF, urologists providing a majority of services in surgical settings (ambulatory surgical centers, hospital outpatient and inpatient) will likely have lower revenue increases from Medicare.

Office/Outpatient E/M Visits

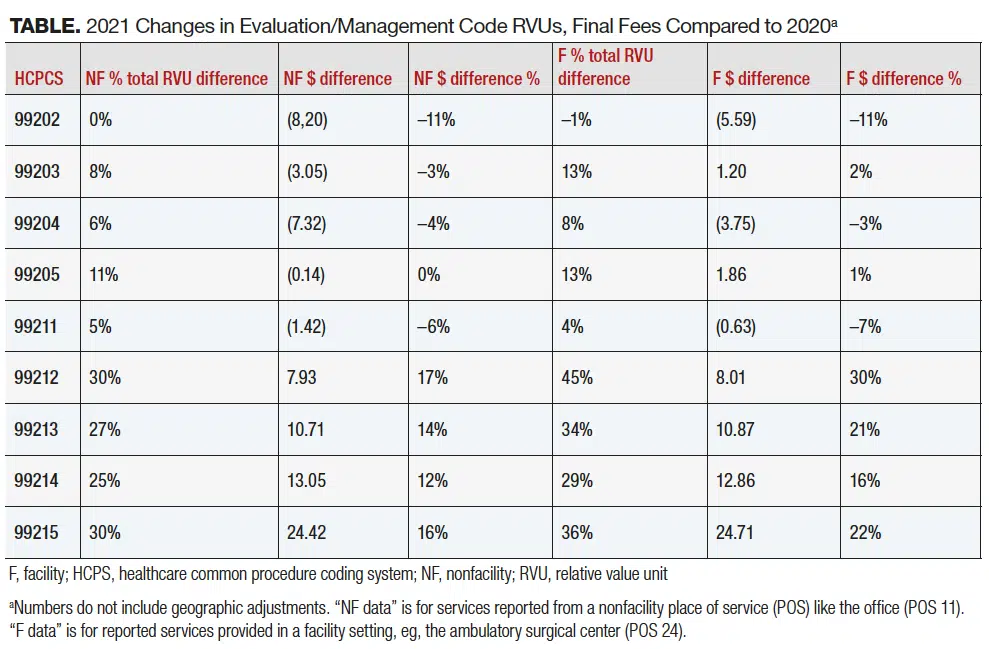

CMS has adopted the changes and associated rules as proposed by the American Medical Association’s 2021 Current Procedural Terminology (CPT) codes. Values for the E/M codes have also been revised and finalized in the rule, resulting in increased payment. Code 99201 has been deleted. Code 99211 has been retained without change.

This represents the first major change in E/M codes in over 25 years. New guidelines allow greater flexibility for documentation of history and physical examination by allowing one to document what is medically appropriate while excluding these sections from level determination. Choosing a billing level for office/outpatient E/M services will now be determined by either medical decision-making (MDM) or total time. The MDM guidelines have been revised to reflect risk and avoid payment for data separately reported or billed. Time has been revised to include the total time that the provider spends on the patient for that visit, including pre-, intra-, and postservice time. Other categories of E/M codes, including consultations not paid for by Medicare, hospital visits, and emergency department visits, will continue to follow current guidelines. The Table includes the changes to E/M codes for both the RVUs and the final fees as compared to 2020.

The proposed add-on code GPC1X was finalized as G2211 (visit complexity inherent to E/M associated with medical care services that serve as the continuing focal point for all needed health care services and/or with medical care services that are part of ongoing care related to a patient’s single, serious condition or a complex condition). List the code separately in addition to office/outpatient E/M visit, new or established. This code can be added on to any level outpatient visit code (99212-99215, 99201-99205) for providers who meet the criteria listed in the descriptor, including urologists managing a patient’s single, serious condition or complex condition. As a Healthcare Common Procedure Coding System (HCPCS) code, this can be applied only to Medicare patients. In the proposed rule, Medicare assumed this code would be reported with 100% of office/outpatient E/M visits by specialties that rely on office/outpatient E/M visits to report the majority of their services. However, because it may take some time for practitioners to begin reporting HCPCS add-on code G2211, CMS assumes for CY 2021 that it will be reported with 90% of office/outpatient E/M visits by specialties that rely on these visits to report the majority of their services, including urology.

CMS determined that when using time, the add-on CPT code 99417 for 15 minutes of prolonged time over the time of 99215 or 99205 was confusing; therefore, CMS created HCPCS code G2212: “Prolonged office or other outpatient evaluation and management service(s) beyond the maximum required time of the primary procedure that has been selected using total time on the date of the primary service; each additional 15 minutes by the physician or qualified healthcare professional, with or without direct patient contact. (List separately in addition to CPT codes 99205, 99215 for office or other outpatient evaluation and management services).

“(Do not report G2212 on the same date of service as 99354, 99355, 99358, 99359, 99415, 99416).

“(Do not report G2212 for any time unit less than 15 minutes).”

The code is descriptive in both use and restriction. Whereas CPT guidelines stipulate that CPT 99417 can be used starting 15 minutes above the threshold to reach 99205 or 99215 (60 and 40 minutes, respectively, so use 99417 when time reaches 75 and 55 minutes), G2212 is to be used when reaching 15 minutes above the maximum range for 99205 and 99215 (74 and 54 minutes), so one can use G2212 when total time reaches 89 and 69 minutes. G2212 can be reported more than once in addition to the appropriate base code, but only for each full 15 minutes above the previous combined time.

Telehealth

As proposed, CMS has expanded the number of services payable under telehealth. Several services were added to the permanent covered list, including the 2 new HCPCS codes G2211 and G2212.

CMS has also finalized for the duration of 2021 the inclusion of a list of services that will be covered under telehealth rules. These codes include established patient codes for rest home visits (99336-99337), home visits (99349-99350), and therapy services (97161-97168, 97110, 97112, 97116, 97535, 97750, 97755, 97760, 97761, 92521-92524, 92507). This list also includes adult and pediatric critical care codes (99469, 99472, 99476, 99478-99480, 99291-99292) and discharge codes for nursing facilities (99315-99316), hospitals (99238-99239) and observation management (99217). Emergency department codes (99281-99285) and subsequent observation codes (99224-99226) are also included on the temporary list.

Coverage for telehealth will revert to pre-PHE rules for the remainder of 2021 once the PHE is discontinued. This means that all services on the covered list, including E/M codes, will be covered only if the patient is located in a health professional shortage area (mostly rural areas) and in an approved Medicare facility (a location with billing privileges for Medicare). Additionally, services will need to be provided to patients who have an established relationship with the provider (physician/APP), with some noted exceptions, including hospital, emergency department visits, and outpatient visits conducted with a patient under the care of another physician during the visit. Telehealth visits after the PHE ends should be reported using POS 02 and will be reimbursed at the facility rate.

Services provided via telehealth technology when the patient and the physician/advanced practice provider are located within the same facility are not considered telehealth visits and will instead be considered as covered. These services should be reported as if the encounter were face to face.

Remote Patient Monitoring Services

The final rule has provided clarification with 2 changes for codes 99453, 99454, 99457, and 99458. Remote patient monitoring (RPM) services can only be furnished to established patients once the PHE ends. RPM services for codes 99453 and 99454 may be reported as incident to the billing practitioner’s services and under their supervision and included contracted employees. Devices used for these services must be FDA approved medical devices. Sixteen days of data each 30 days must be collected and transmitted to meet the requirements to bill CPT codes 99453 and 99454. For CPT codes 99457 and 99458, an “interactive communication” is a conversation that occurs in real time and includes synchronous, 2-way interactions that can be enhanced with video or other kinds of data, and the 20-minute requirement for the service can include time for furnishing care management services in addition to the required interactive communication. These services can be provided for chronic or acute problems but cannot be reported for remote data collection for purely diagnostic purposes. Time for these services can include the time spent by staff under the direct supervision of the patient (“incident to”).

Direct Supervision

CMS finalized that direct supervision may be provided using real-time, interactive audio and video technology through the “later of the end of the calendar year in which the PHE ends or December 31, 2021.”

Changes in Part B Drug Payments

The Trump Administration issued a final rule on November 20, 2020 initiating a significant change for payment rates for the top 50 drugs for part B Medicare. The rule is being challenged by multiple affected entities including LUGPA. There are 7 drugs that have been identified in the list that may affect urology practices. We are monitoring this new rule and will provide updated information in a later article.

For More Information: 2021 final rule includes adoption of major e m code changes