Medicare Advantage (MA) plans, a type of private health insurance, have become increasingly popular among seniors. These plans offer additional benefits beyond traditional Medicare, but they also come with their own set of complexities. One of the most significant issues faced by MA beneficiaries is Medicare Advantage denials for medical services.

Recent data has revealed a concerning trend: Medicare Advantage denials increased even before the implementation of new prior authorization rules.

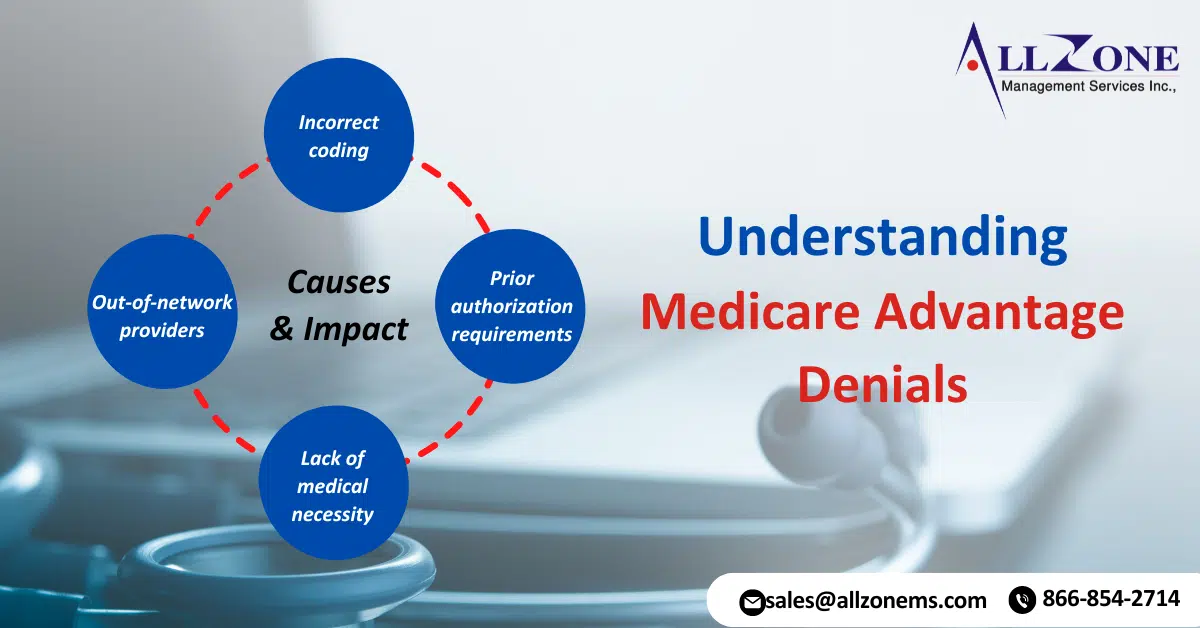

Understanding Medicare Advantage Denials

A denial occurs when an MA plan refuses to cover a specific medical service. This can happen for various reasons, including:

-

- Out-of-network providers: If a beneficiary receives care from a provider not in the MA plan’s network, they may face higher costs or denials.

- Incorrect coding: Errors in medical coding can lead to denials, as insurance companies may not recognize the service.

- Prior authorization requirements: Some medical services require prior approval from the MA plan before they can be covered. If this approval is not obtained, a denial may result.

- Lack of medical necessity: The insurance company may determine that a particular service is not medically necessary and therefore will not be covered.

The Rise of Medicare Advantage Denials

According to a recent study, Medicare Advantage denials have been on the rise in recent years. This trend is particularly concerning given the increasing reliance on MA plans by seniors. Several factors have contributed to this increase:

-

- Growth of MA plans: As more seniors enroll in MA plans, the number of claims processed also increases. This can lead to a higher volume of denials.

- Tightening of benefits: Some MA plans have become more restrictive in their coverage, resulting in a higher likelihood of denials.

- Increased use of prior authorization: Prior authorization requirements have become more common in MA plans, which can lead to delays and denials.

- Complex regulations: The rules governing MA plans are complex and can be difficult for beneficiaries to understand. This can lead to errors and denials.

The Impact of Denials on Beneficiaries

Denials can have a significant impact on MA beneficiaries. When a claim is denied, beneficiaries may be responsible for the full cost of the medical service. This can be a financial burden, especially for seniors on fixed incomes. In addition, denials can cause stress and anxiety for beneficiaries who are already dealing with health issues.

The Role of Prior Authorization

Prior authorization is a process that requires a healthcare provider to obtain approval from an insurance company before a medical service can be provided. This is often used for expensive or experimental treatments. While prior authorization can help to ensure that only necessary services are covered, it can also lead to delays and denials.

The New Prior Authorization Rules

In an effort to address concerns about prior authorization, the Centers for Medicare & Medicaid Services (CMS) has implemented new rules that are designed to streamline the process and reduce denials. These rules include:

-

- Standardized prior authorization forms: CMS has developed standardized forms that healthcare providers can use to request prior authorization. This should help to reduce errors and delays.

- Timeframe requirements: The new rules set specific timeframes for insurance companies to respond to prior authorization requests. This is intended to prevent unnecessary delays.

- Appeals process: The rules also include a more streamlined appeals process for beneficiaries who have had their claims denied.

Allzone Management: You’re Guide to Medicare Advantage Denials

The increase in Medicare Advantage denials is a serious issue that needs to be addressed. While the new prior authorization rules may help to improve the situation, it is important for beneficiaries to be aware of their rights and to take steps to protect themselves from denials. By understanding the factors that can lead to denials and knowing how to appeal a denial, beneficiaries can help to ensure that they receive the care they need.

Allzone Management, a medical billing company, can help beneficiaries navigate the complex world of Medicare Advantage denials. Our experienced team of professionals can assist with prior authorization requests, appeals, and other billing issues. We can also help beneficiaries understand their rights and options, so that they can get the care they need.