After three years of policy proposals, the American Medical Association Current Procedural Terminology (CPT) panel responses, and substantial guidance from gastroenterology and other specialty societies, changes to the office/outpatient evaluation and management (E/M) codes became effective as of January 2021. Some aspects of these revisions took effect for telehealth services since spring 2020 for Medicare, but now all payors should be adopting the changes.

Which Codes Are Affected?

- Office or other outpatient codes, and some new codes related to prolonged services, complex services and a proposed new G code for a longer “virtual check-in” service.

- Codes 99201 to 99215 (office or other outpatient visit for the evaluation and management of a new/established patient) have changed with deletion of 99201, because of low usage and the fact that its element of medical decision making is the same as 99202. The definitions of new or established patients have not changed, but physicians should read the introductory material in CPT 2021 to understand the nuances.

The Key Revisions

Look at one code as an example; all the others are similar:

- 99202 Office or other outpatient visit for the evaluation and management of a new patient, which requires a medically appropriate history and/or examination and straightforward medical decision making.

- When using time for code selection, 15 to 29 minutes of total time is spent on the date of the encounter.

Thus, there is no specific requirement for the amount of history, systems review or the extent of the physical exam; most of the bullet points and bean counting are gone. A “medically appropriate history and/or examination” is what you believe are the key data, sufficient for medicolegal purposes and to substantiate the medical necessity of the service. The old “level 2” exam or more would be expected when medical decision making rather than time becomes the basis of code choice.

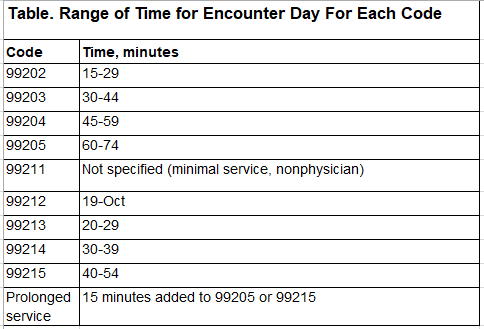

Each code in the group has either a range of time, which is the total time on the calendar date of the encounter, and can be the basis of billing that level; or one of the four levels of medical decision making, which remains straightforward: low, medium or high level.

What Is ‘Time’ in 2021?

Time that can be reported must be the professional’s and/or that of the physician assistant or nurse practitioner, not the other staff, and includes the following types of work:

- preparing to see the patient (e.g., reviewing tests);

- obtaining/reviewing separately obtained history;

- performing a medically appropriate exam and/or evaluation;

- counseling/educating the patient, their family or caregivers;

- ordering medications, tests or procedures;

- referring and communicating with other health care professionals (when not separately reported);

- documenting clinical information in electronic or other health records;

- independently interpreting results (not separately reported) and communicating those results to the patient, their family or caregivers; and

- care coordination (when not separately recorded).

Prolonged service codes have two flavors that I suspect will be reconciled by CPT eventually. The CPT panel passed 99417, which could be reported at 15 minutes beyond the low end of the time for 99205 or 99215—a peculiar requirement since it means you could report 99215 plus 99417 after 55 minutes of service.

The Centers for Medicare & Medicaid Services (CMS) noticed this last summer and said they would not accept such coding; instead, CMS issued G2212, but this code cannot be reported until a total of 74+15=89 minutes for 99205 or 54+15=69 minutes for 99215 has been met. G2212 has a work relative value unit of 0.61 and pays about $31:

- G2212 Prolonged office or other outpatient evaluation and management service(s) beyond the maximum required time of the primary procedure which has been selected using total time on the date of the primary service; each additional 15 minutes by the physician or qualified health care professional, with or without direct patient contact. (List separately in addition to CPT codes 99205 and 99215 for office or other outpatient E/M services.)

Reader Mailbag:

I read your column in the February 2021 issue of Gastroenterology & Endoscopy News titled “Telehealth Coding and Reimbursement in 2021” (see page 38).

I am finding that as of January 2021, United Healthcare (UHC) and Oxford commercial plans required POS as 02 for my physician’s telehealth E/M claims and are reimbursing less than if the practice is office-based.

This is a new policy change for the insurance, and I am writing to seek advice on what, if anything, I can do to circumvent the lower reimbursement.

When I used POS 11 and CPT 99213, for a DOS 2-23-2021, the claim is rejected at the clearinghouse with this message:

Claim has been Rejected as unprocessable. Cannot provide further status electronically. X12 Info-2300 CLM. Claim has been rejected as unprocessable. Missing or invalid information. (A3:0’)

P4999 utele smartedit utele pattern 30866 procedure code 99213 should be reported with telehealth place of service 02. Telehealth modifiers are no longer required. Update codes as applicable. (A3:585:pr) (utele pattern 30866 procedure code 99213 should be reported with telehealth place of service 02. Telehealth modifiers are no longer required. Update codes as applicable.)

The Oxford provider representative told me Jan. 1, 2021, UHC and Oxford commercial plans are requiring POS 02 for any telehealth visits. The representative directed me to a UHC policy and guidance from the UHC provider portal for reference. I resubmitted my claim with POS 02 and claim processed with a lower reimbursement than if the practice is office based.

I would appreciate any guidance. We are currently not seeing patients in person for office appointments. However, the physician is performing procedures and inpatient consults at the hospital.

Jody P.

Staten Island, N.Y.

Code Green Responds

My sympathies about the unfair reimbursement that some commercial payors are allowing for telehealth services. There are many variations in how commercial payors provide coverage and variations in how they require providers to bill. Although many are providing payments at parity with office services during the public health emergency, some never did, and some have changed from parity to “under reimbursement.” Their rationale is that it costs less to provide a telehealth service than in-person visit (which we know isn’t really true).

Assuming you have a contract with the payors in question, there isn’t much recourse except to inform patients that their insurance payor doesn’t cover telehealth services at a level you can afford to provide them.

For more information: E M Coding for 2021 What s New and Different