A thorough understanding of the latest guidelines for coding evaluation and management services is necessary to ensure compliant claims.

You’ve likely heard about the 2023 CPT® changes for reporting hospital inpatient and observation evaluation and management (E/M) services. AAPC has been preparing medical coders for these changes since they were announced and started offering education as soon as the American Medical Association’s CPT® Editorial Panel finalized the changes.

E/M Guidelines: CPT® vs. CMS

Two years after the AMA revised the E/M coding guidelines for office and other outpatient services, we now have consistency throughout this section of CPT® and, for the most part, among payers. Although, “there are some notable differences in this area when it pertains to CPT® versus CMS,” Jimenez forewarned.

“One of the biggest changes, I think, in the 2023 changes was the elimination of observation codes,” Jimenez said. Effective Jan. 1, 2023, hospital observation codes 99217-99220 and 99224-99226 are deleted. These services are merged into the existing hospital inpatient services codes 99221-99223, 99231-99233, and cpt code 99238-99239, and the subsection is renamed Inpatient Hospital or Observation Care. As in the Office or Other Outpatient Services subsection, the descriptors for these codes are revised to allow for the use of total time or level of medical decision-making (MDM) for code-level selection.

Initial Care

Historically, only the admitting physician was able to use the initial hospital care codes (cpt code 99221-cpt code 99223). CPT® 2023 E/M guidelines now state: “An initial service may be reported when the patient has not received any professional services from the physician or other qualified health care professional (QHP) or another physician or QHP of the exact same specialty and subspecialty who belongs to the same group practice during the stay.” CPT® considers advanced nurse practitioners and physician assistants who are assisting a physician to be of the same specialty and subspecialty as that physician and, therefore, may not separately bill for their services.

Note: The Centers for Medicare & Medicaid Services (CMS) does not have a subspecialty designation, so they’re just looking at same group, same specialty.

CPT® clarifies in the 2023 E/M guidelines that a hospital admission is from when the patient is admitted until when the patient is discharged. “That’s one course of admission,” Jimenez said, “so they [the payers] would expect to see only one initial code for that course of stay from practitioners of the same specialty and subspecialty who belong to the same group practice.”

Subsequent Care

For the subsequent care services (cpt code 99231-cpt code 99233), Jimenez provided an example of proper use: “Let’s say that a patient is admitted to observation, and then it’s decided to admit them to inpatient. You would use the subsequent care codes because they’ve already received an initial hospital service. You can only use one initial care code,” she said.

The practitioner who orders observation care for a patient is still the one who bills for the initial service. Any other practitioner interacting with the patient while they are under observation care is going to bill the office and other outpatient services E/M, not the subsequent hospital care codes.

When to Use Modifier 25

“Another area where we see a difference in CPT® guidance versus CMS guidance is whether or not you can code for two E/M services on the same date of service,” Jimenez said. According to 2023 CPT® E/M guidance, if a patient has a service somewhere else, another site of service, where they have an encounter and then they end up being admitted, both services could be reported with the use of modifier 25 Significant, separately identifiable evaluation and management service by the same physician or another qualified healthcare professional on the same day of the procedure or other service.

This is fine if the services are provided by two different providers who are not of the same specialty and subspecialty within the same group practice. “When it becomes an issue is when it’s the same practice,” Jimenez said. “Let’s say that the primary care physician started seeing the patient in the office and then met the patient at the hospital to admit them. The course of work over that date of service is going to be included to report one level of service, one E/M per group, per specialty.”

Based on this example, only the admission should be reported. But from a CPT® perspective, the primary care physician could bill separately for the office visit and the admission. This is one example of why it’s essential to know your payer policies. “Most payers have the one E/M, one date of service rule,” Jimenez said.

An exception to this rule is allowed for emergency department and critical care services, however. “Both CMS and CPT® will allow for the emergency department and the critical care to be billed on the same day,” Jimenez said, “… but you would have to defer to what CMS requires for these to be separately billable.”

Definition of “Calendar Days”

Now that the hospital care codes can be applied based on MDM or time, there will be instances when a single service extends two calendar days. CMS guidelines say that when the course of an encounter crosses two dates of service, only one date of service is reported — the date the encounter began.

Per the 2023 Medicare Physician Fee Schedule (MPFS) final rule, “a billing practitioner shall bill only one of the hospital inpatient or observation care codes for an initial visit, a subsequent visit, or inpatient or observation care (including admission and discharge), as appropriate once per calendar date.” CMS clarifies that “per day” in the CPT® code descriptors, is also referred to as “date of encounter,” and is the same thing as “calendar date.”

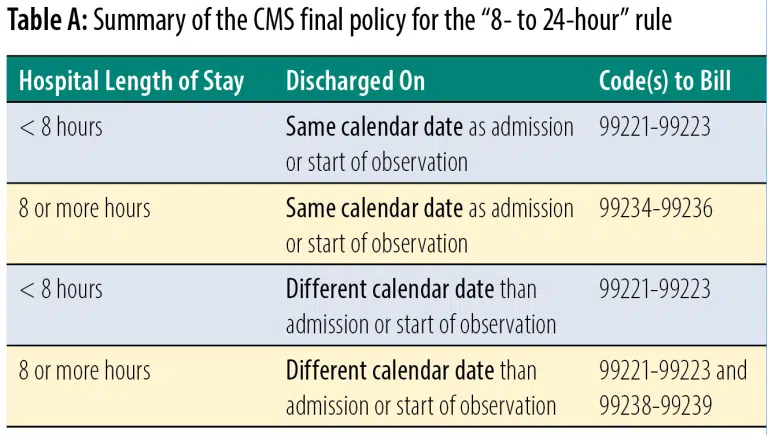

Of note, CMS is keeping the “8- to 24-hour” rule. In the 2023 MPFS final rule, CMS included Table 22 to show how it is applying this rule (see Table A). “I would keep this table handy and refer back to it so that you know what code ranges should be used,” Jimenez said.

Coding Time

One area that will require close attention is the change in the existing initial and subsequent care code descriptors when it comes to time. In the office and other outpatient codes, we’re given a code range, but for initial inpatient and observation cpt codes 99221-99223, we’re given a minimum time that must be met. If the minimum time is not met, then MDM should be used to select the code level.

For initial hospital inpatient or observation services of 90 minutes or longer (99223), subsequent services of 65 minutes or longer (99233), and inpatient or observation care services of 100 minutes or longer on the same date of service (99236), you will use new prolonged services code 99418 — unless the payer is Medicare. CMS created its own G codes for prolonged services. HCPCS Level II code G0316 is specific to hospital inpatient and observation care. (There are two new G codes for nursing facility services and home visits, as well.)

The following is a list of activities that can be used when defining total time:

- 1. Preparing to see the patient (e.g., review of tests)

- 2. Obtaining and/or reviewing a separately obtained history

- 3. Performing a medically appropriate exam and/or evaluation

- 4. Ordering medications, tests, or procedures

- 5. Referring and communicating with other pros (when not separately reported)

- 6. Counseling and education

- 7. Documentation

- 8. Independent interpretation of results

- 9. Care coordination

Clinical staff time cannot be included in total time, nor can the time that was spent performing other billable services. “An audit focus should be making sure we’re not double counting time,” Jimenez said. “You want to make sure that you clearly see documentation saying that the documented time does not include other billable services.”

CMS is looking for a time statement — the total time spent and all the activities that were performed to get to that time. It’s not necessary for the physician to document how much time was spent performing each activity, but the total time and the list of activities should make sense. Saying “spent 30 minutes” without accounting for that time is a problem.

“We expect to see a history and exam as auditors,” Jimenez said. “We are going to be using the entirety of the record to support services.” This information will help auditors understand the complexity and the nature of the encounter.

Time audit concerns include:

- Reporting the same time for all encounters.

- Rounding up time to reach a higher-level E/M

- Not carving out time that was spent performing other billable services

- Total time for the date of the encounter

- Mixing CPT® and CMS codes/guidelines

Auditors should check carefully that the differences in time standards among some of the codes, such as those for prolonged services, are used correctly, Jimenez said.

Put Your E/M Knowledge to the Test

There are considerable changes to the E/M services guidelines, including the MDM table, which Jimenez spent time discussing during her presentation before reviewing some documentation examples for inpatient and observation coding.

For More Information: 86922 coding inpatient and observation visits in 2023