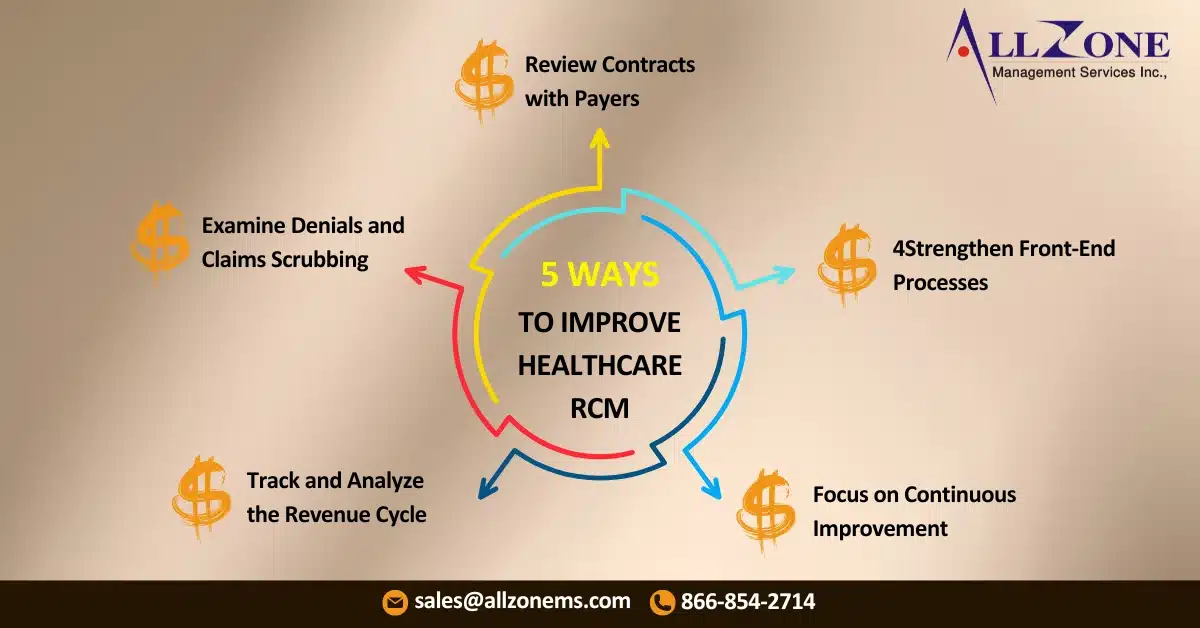

The healthcare industry operates under a unique framework. Unlike traditional businesses where customers pay directly for a product or service, healthcare providers navigate a complex system involving multiple players, including payers, claims management, and reimbursements. To Improve Revenue Cycle Management, healthcare providers must understand this intricate system and implement efficient strategies to optimize their revenue cycle.

| Table of Contents |

This intricate structure makes maintaining cash flow and ensuring timely payments a significant challenge. However, like any industry, managing revenue and cash flow remains a critical priority. To help your healthcare organization address these complexities, here are actionable strategies to enhance revenue cycle management (RCM).

1. Track and Analyze the Revenue Cycle

Understanding and tracking your revenue cycle is the cornerstone of effective RCM. If you are already doing this, there’s always room for improvement. If not, starting now is essential. The principle here is simple: “You can’t manage what you don’t measure.”

Begin by setting clear strategic goals and benchmarks that define your ideal financial performance. Once these objectives are established, collect data from patients and payers to evaluate your performance in key areas. The healthcare industry is rich in data, and numerous software solutions can help consolidate and analyze this information effectively. These insights will reveal areas for improvement and opportunities to optimize your revenue cycle.

2. Examine Denials and Claims Scrubbing

One of the biggest challenges healthcare providers face is claims denial or partial reimbursement from insurance companies. To Improve Revenue Cycle Management, you must identify the reasons behind these denials and implement corrective measures.

Common reasons for claim denials include:

- Patient ineligibility

- Incomplete patient or plan information

- Missing supplemental attachments

- Incomplete service details

- Duplicate claims

- Submission to the wrong payer

- Coding errors

Most of these issues are preventable. By identifying patterns in denials, you can enhance processes for both your front-end and back-end teams, reducing errors and improving payment rates.

3. Review Contracts with Payers

Another common barrier to full reimbursement is payers not adhering to contract terms. While minor discrepancies may not seem worth pursuing, they can accumulate over time, significantly impacting your revenue.

For large-ticket reimbursements, conduct thorough contract reviews to ensure compliance. If a payer frequently underpays, expand the review to smaller items within that contract. Regularly scheduled reviews—whether quarterly, biannually, or annually—can help ensure consistent and accurate payments across all contracts.

Streamline Your RCMOptimize Revenue Cycle, Maximize Profit |

4. Strengthen Front-End Processes

Revenue cycle management doesn’t begin at the back end. A robust front-end process is critical to minimizing errors and delays in payments. By optimizing front-end operations, you reduce the burden on back-end teams and improve the overall revenue cycle.

Studies reveal that over half of medical bills under $500 remain unpaid, especially among younger patients. To address this, consider implementing:

- Pre-service cost estimates: Nearly half of Millennials are more likely to pay upfront when given an estimate.

- Card-on-file payments: While credit and debit cards are the most common payment methods, many practices don’t retain these details for future transactions.

Streamlining point-of-service payments and establishing pre-service payment plans can significantly improve your revenue cycle’s starting point.

5. Focus on Continuous Improvement

Efficient revenue cycle management requires continuous monitoring and refinement. By leveraging data, identifying bottlenecks, and improving processes across the board, healthcare organizations can achieve noticeable improvements in Improve Revenue Cycle Management.

The ultimate goal? To reduce financial worries and focus more on delivering exceptional patient care.

With these strategies in place, you can optimize your revenue cycle, ensuring smoother operations, improved cash flow, and, ultimately, better outcomes for both your patients and your business.

How to Reduce Claim Denials and Boost Revenue Cycle Efficiency

Claim denials can be a significant drain on your revenue cycle. Proactive revenue cycle management (RCM) approaches can help you reduce these denials and improve your cash flow. Here are some tips:

Allzone RCM Company suggests the following proactive RCM approaches:

- Clean and Accurate Data: Ensure your patient data is accurate and up-to-date. This includes demographic information, insurance details, and medical codes.

- Eligibility Verification: Verify patient eligibility before providing services. This helps avoid denials due to incorrect insurance information or lack of coverage.

- Prior Authorization: Obtain prior authorization for services that require it. This reduces the risk of denials for non-covered services.

- Coding and Billing Accuracy: Use accurate coding and billing practices to ensure claims are submitted correctly. This minimizes the chance of denials due to coding errors.

- Claims Scrubbing: Use claims scrubbing software to identify and correct errors before submitting claims. This can significantly reduce denials.

- Regular Reviews: Conduct regular reviews of your RCM processes to identify areas for improvement. This helps you stay proactive and address potential issues before they become problems.

Strong Relationships with Payers: Build strong relationships with payers to understand their specific requirements and resolve issues quickly.

By implementing these proactive RCM services approaches, you can significantly reduce claim denials, improve revenue cycle management, and ultimately enhance your financial performance. Partnering with experienced RCM companies ensures you have the right strategies in place to maximize efficiency and collections.